We’re sure you have all seen the many VERY MISLEADING, outright false, click bait news headlines about the recent NAR commission lawsuit settlement from supposedly “reliable” news sources, such as the ones shown below…

- USA Today: “As spring homebuying season kicks off, a NAR legal settlement could shrink realtor commissions”

- FOX 11 News Los Angeles: “Realtors 6% commission on buying, selling homes eliminated: Here’s why”

- CNN Business: “The 6% commission on buying or selling a hoe is gone after Realtors association agrees to seismic settlement”

- Fortune: “The huge $418 million realtor settlement means you can find a home online without having to pay a buyer’s agent commission”

- Reuters: “Home buying costs could fall in big US real estate group settlement”

It is our duty as your REALTORS® to educate you on the facts of Real Estate, including the FACTS of this settlement.

The facts are, NONE of those headlines are even remotely true. The FACTS are, as shown in the image below, the settlement agreed upon merely removes 2 line items from the MLS intake form where the cooperating Buyer’s agent and Sub agent commissions are currently listed, and a Buyer’s Representation Agreement is now Required for all brokerages, instead of just merely suggested.

Verbiage from NAR settlement explaining what could be changing once the DOJ makes a decision on the case.

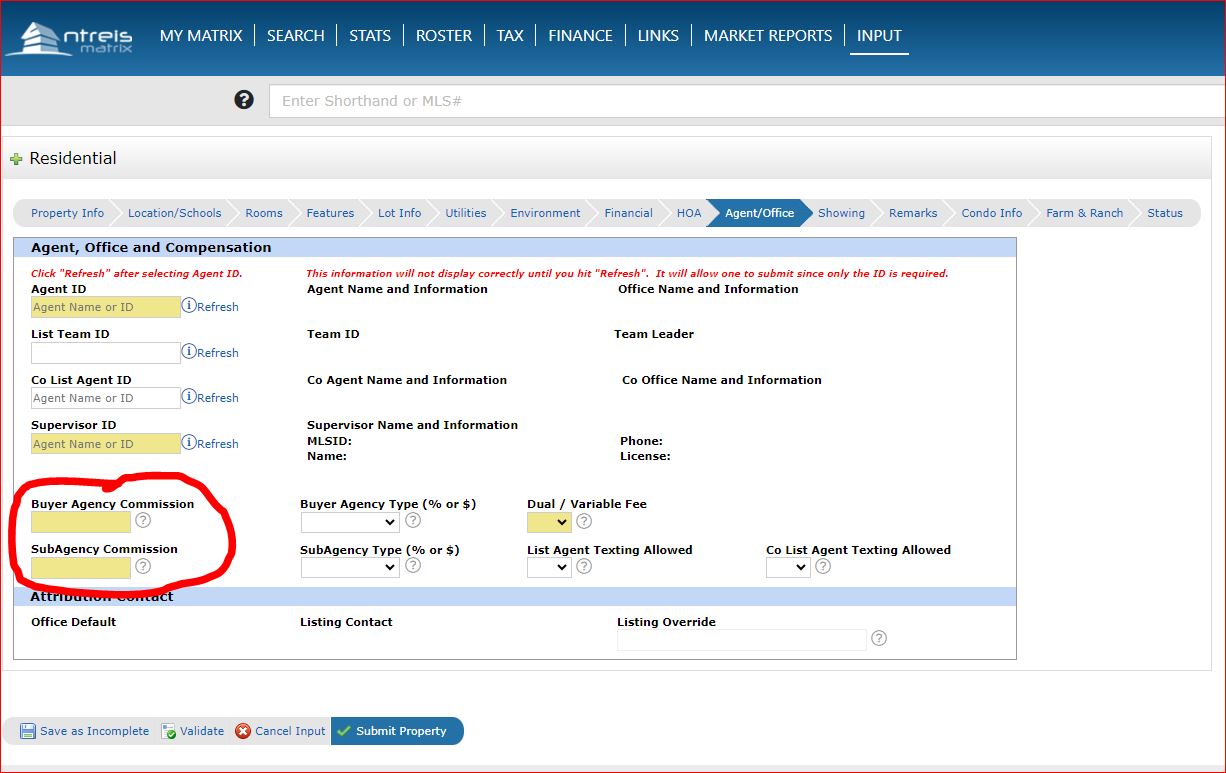

As it is currently, and shown in the image below, there are currently 2 fields on the MLS Intake form that are required fields where the seller’s broker/agent can input a percentage amount they are willing to offer a cooperating broker for bringing a buyer offer contract. The term “Required” DOES NOT mean they are required to offer buyers agent compensation, it simply means they have to put a number in that field in order to submit the form. ZERO is a number! They have always had the option to put Zero or any other number they so choose, as long as the field is not left blank. The settlement merely removes those fields off of the form. That’s it. The removal of the fields does not remove the option to offer a buyers agent commission, and does not mean the removal of agent commissions all together. Buyers agent commission is still negotiable between brokers, it just will no longer be printed on the MLS form.

These two fields are currently required fields, meaning a number0-9+ has to be entered in the field in order to submit the form. The agent has the choice of what number they input, even if it is zero, just as long as the field is not left blank.

The settlement simply removes these fields off of the form.

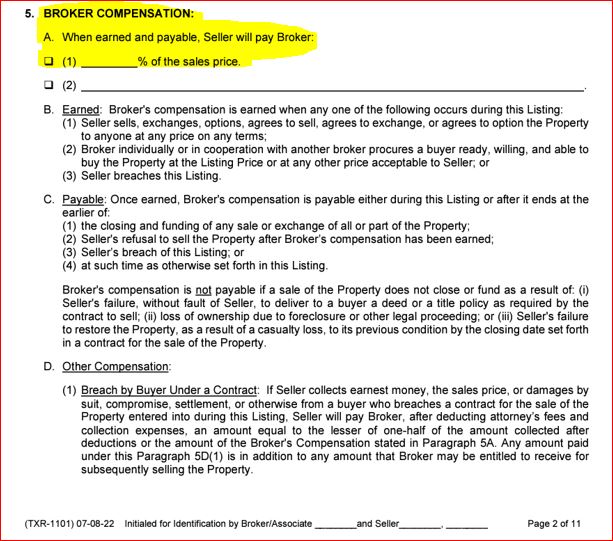

The headlines above, along with other headlines, and the whole lawsuit itself has created confusion and assumptions regarding who pays the buyers agent commission. The complaintants posit that the seller pays the commission of both sides, which is false. Sellers do not pay the buyers commission, they ONLY pay their broker’s commission. It is clearly stated on the Listing Agreement between the Seller and the Seller’s Broker, that the seller agrees to pay their broker an agreed upon commission. As a service provider, it is the Broker’s place to set his/her commission for the services provided. There is no “Standard” rate. There are no federal or state laws that set commission rates. There is no conspiring to fix commission rates. Some brokers charge 7-8% while other broker’s charge 2-3%. But it is up to each Broker to decide what he/she wants to charge for their services rendered. The AVERAGE commission and competitive rate charged by many brokers is usually 5-6%. And when signing the listing agreement, the Seller can negotiate that price, just like when buying a car, or paying a plumber. And it is the broker’s prerogative to hold firm on the amount they charge for their services, and it is the seller’s prerogative to accept the rate, or walk away and find another broker who charges a rate the seller prefers. This rate is and always has been a negotiable rate between the Seller and the Seller’s broker for the services rendered by the broker to get the seller’s home sold. See below.

The highlighted text is a negotiated agreement on the amount the seller’s broker is charging the seller for the services of the broker to get the seller’s home sold.

No where in the listing agreement does it say anything about the seller paying they buyer’s broker.

The amount currently input into the fields on the MLS intake form is decided by the seller’s broker from the commission earned for services rendered. It is the seller’s broker’s right to divvy up and spend the broker’s commission anyway he/she sees fit to fulfill their contract of selling the seller’s home. The broker spends part of their commission paying for the administration expenses of their brokerage, E&O Insurance for their agents, advertising, the listing agent’s commission split, other costs of doing business, and if they so choose, the seller’s broker may decide to spend half or part of their commission to offer a commission to the buyer’s agent for their services of bringing them a buyer and helping fulfill the contract of getting the home sold. It is NOT the seller paying this. And the broker is not obligated to offer this commission to the buyer’s agent, they do it on their own accord with the commission they earned for selling the house as contracted.

Some headlines claim that buyers no longer have to pay a brokers commission, which is and misleading, while other headlines claim that buyers now have to pay the buyers commission in full, out of pocket (implying the never had to before). This is why a buyers rep agreement has always been strongly encouraged, and could possibly become required in July once the DOJ makes their decision.

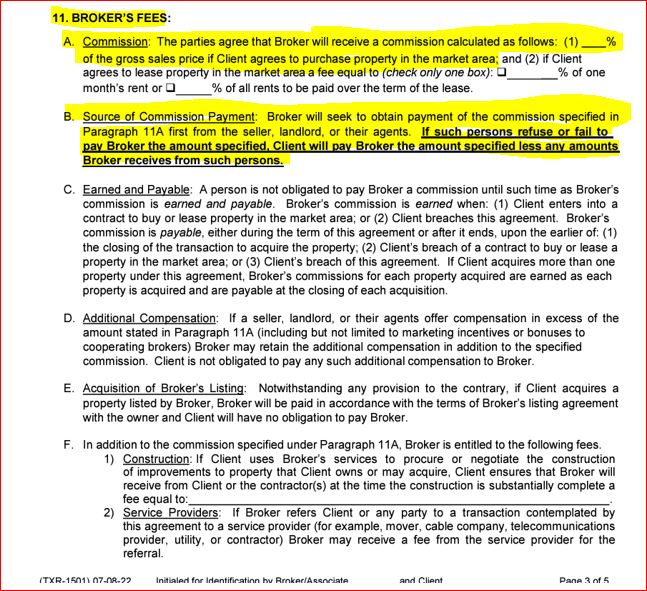

The Buyer’s rep agreement is an agreement between the buyer and the buyer’s broker that the Buyer’s broker will receive a commission of a certain percentage decided on by the buyer’s broker for services rendered in representing the buyer in finding, negotiating, and navigating the legal aspects of the purchase of a home. It further states that the buyer’s broker will first seek commission payment from the seller (via seller’s concessions in the purchase offer contract) or via the seller’s broker (if the broker is offering a cooperating buyer’s agent commission) and if the seller and the seller’s broker refuse to pay all or part of the commission amount agreed upon in the buyer’s representation agreement, THEN the buyer will be responsible for paying all or the remaining amount of the agreed upon commission fee for services rendered. See below.

Verbiage from the Buyer’s Representation Agreement.

So how are commissions paid, and how much does the seller’s agent and buyer’s agent actually get when it is all said and done?

As an example, Per the listing agreement, the Seller agrees to pay their Broker 6% to sell their home for $350,000.

At closing, Seller’s Broker receives $21,000 commission for selling the house as agreed in the contract.

From that $21,000 Broker has to pay: costs of doing business, which may or may not include paying a cooperating buyer’s agent commission.

In this case, we’ll say the seller’s broker offered a cooperating buyer’s broker fee of half of the commission they earned for the sale of the home, which is 3%, or $10,500 to the buyer’s broker.

Out of the remaining half of the commission the Seller’s broker earned, the seller’s broker pays his/her agent 60% of the remaining half of the commission. (This commission split also varies between brokers and is sometimes 100%, 70%, or even 50%.) Leaving the Broker, in this case, 40%, or $4200, to pay for Administrative fees, E&O Insurance, Advertising, payroll, and other costs of doing business.

The Seller’s agent received 60% of the remaining half of their broker’s commission, which is $6300. Out of that, the agent pays for their brokerage fee, transaction fee, advertising expenses they incurred in selling the home, MLS fee, NAR fee, realtor board fee, Supra-EKey fee, cell phone, and other costs of doing business.

Out of the 3% the buyer’s broker received from the Seller’s broker, it is divided up between the brokers costs of doing business and the agent commission split similarly to the seller’s broker costs and seller’s agent commission. And the buyer’s agent has similar expenses to pay from their commission such as gas for driving around showing multiple houses to their client, tolls, cell phone, brokerage fee, mls fee, NAR dues, Realtor board dues, and other costs of doing business.

So, to wrap this all up and hopefully put an end to the confusion, Sellers are not required and never have been required to pay the buyer’s agent fees, Commissions are not going away, There is NO STANDARD commission, commissions are and always have been negotiable between brokers and their clients, and between Sellers broker and Buyer’s broker. Seller’s agents do not get the full amount of the commission listed in the listing contract and buyer’s agents do not get the full amount listed in the buyer’s rep agreement or the full amount the Seller’s broker may decide to offer. The commissions are split up and spent however each broker deems necessary to fulfill the contractual agreements entered into with the sellers and buyers.

No one gets paid unless the home sells and the sell closes. Agents run the risk of putting in a lot of work for the seller and buyer clients with no guarantee of getting paid. Agents only get paid if the sale closes on both sides.

If you have any further questions regarding all of this, feel free to reach out to us and we’ll explain it the best we can. If we do not have the answers you are seeking, we will find out the answer and get back to you as soon as possible.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link